The history of NFTs

NFTs, also known as Non-Fungible Tokens, have been in existence for nearly a decade. The term “non-fungible” refers to something that is unique and cannot be substituted for another – thus an indication of the item’s authenticity and thwarting the counterfeit market. The earliest issuance of NFTs was done on the Bitcoin blockchain platform in 2012 to authenticate the ownership of any asset, including properties, tickets, and company shares.

While NFTs are now known to be valuable art commodities, NFTs were originally utilized by the gaming industry for game creators to issue virtual assets. Peer-to-peer financial platform and digital asset trading company Counterparty paved the way for NFTs in the gaming and entertainment industry through its collaboration with gaming companies Spells of Genesis and Force of Will.

It was not until 2016 that the art world made their first foray into the NFT space spawning a buying frenzy in the early quarters of 2021.

Comic book character Pepe Frog was added to the Counterparty platform as a meme. Termed “Rare Pepes”, the meme acquired not just a sizeable and zealous fanbase, but also intrinsic value when Ethereum gained popularity. Ethereum as a decentralized, open-source platform, issues its own cryptocurrency Ether, that can be stored on digital wallets for trading purposes.

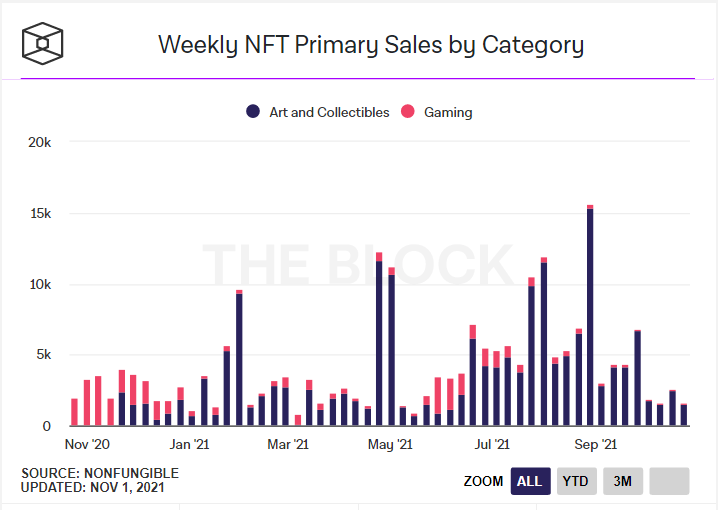

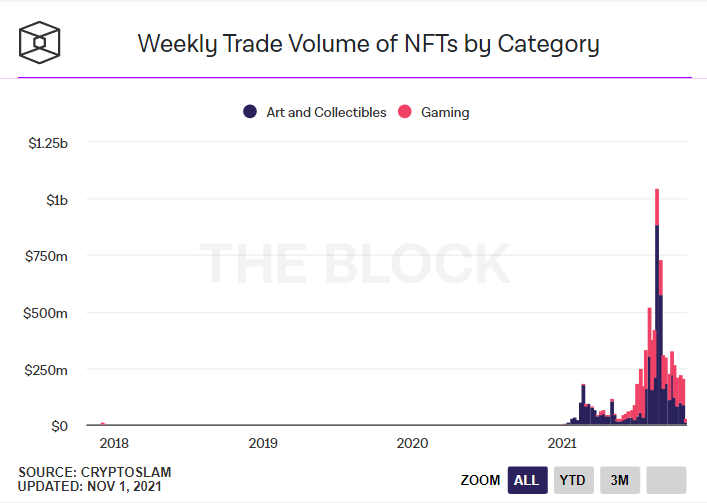

From 2017, other newly created NFTs like Cryptopunks and CryptoKitties have experienced a rapid rise in popularity and come into mainstream adoption. Over the last a couple of years, music and art creators have started capitalizing on the use of NFTs, experiencing a peak in trading volume in September 2021 at nearly 29,000 sales and accounting for more than USD 1 billion in sales value.

Source : NFT Charts: Transactions, Users and Trading Volumes (theblockcrypto.com)

Source: NFT Charts: Transactions, Users and Trading Volumes (theblockcrypto.com)

On 28 October 2021, CryptoPunk was sold for a record-breaking USD 530 million, easily eclipsing the previous record sale of the USD 69 million Beeple NFT in March 2021 by more than 7.5 times.

Basil Hwang from Hauzen LLP prefers to look at NFTs from a contractual and regulatory perspective.

Lawyers and NFTs

On 25 October 2021, Stephenson Law made news as the first law firm to launch its own NFT in a set of three, which serves as “crypto-art tokens that represent legal advice” that enables the purchase the right to redeem their NFT for “one hour of legal advice on the subjects of financial services Regulation, blockchain, and NFTs, along with the strategy, compliance, governance, and documentation necessary of such a new-fangled technology”. One of the NFTs will entitle the purchaser to one-on-one access to Stephenson Law’s founder, Alice Stephenson.

This innovation has drawn much skepticism and criticism amongst legal traditionalists who are quick to accuse the firm of marketing gimmicks. Other critics alleged NFTs as a floodgate of potential money laundering, undermining the integrity of the legal profession.

While NFTs for use in the legal industry are at a nascent stage, the recent trading frenzy has captured the eagle eyes of many legal professions.

NFTs like any other assets, are subject to legal implications with respect to ownership, copyright, fraudulent trading, cyber security, and contractual liabilities. As an emerging technology, there are few lawyers who are currently well-versed in the technicalities of NFT technology.

Basil Hwang from Hauzen LLP prefers to look at NFTs from a contractual and regulatory perspective. Since 2014, Hwang has handled more than 50 cases relating to cryptocurrency regulation tokens, disputes and blockchain contractual arrangements. In a typical NFT transaction, Hwang reviews NFT related contracts and ensures that the contract terms and terms of service are specific and can be upheld by existing legislation and the courts. Hauzen LLP conducts due diligence for clients so that his clients are legally protected, in the event that the transaction fails or in the case of a fraudulent transaction.

Source: ult88cube

The rise of NFT crimes and legal risks

Blockchain as a shared (or decentralized) digital ledger platform has been credited for increasing visibility and transparency, thus helping with fraud detection due to the sharing of real-time information and allowing all participants in a blockchain visibility over transactions. This bypasses the layers created by traditional databases which are administered via a single centralized authority.

With the recent surge in the value of NFTs held on NFT platform, theft and impersonation have also been rife. News reports have covered impersonators who conducted online auctions in the name of Banksy and syndicates that racked up sophisticated NFT scams as in the case of Evolved Apes.

Ironically, the lack of a centralized authority has proven to be a double-edged sword. It can be difficult, if not impossible, to hold any individual or entity accountable. In NFT dealings, NFT platforms such as OpenSea and Rarible have lower barriers to entry as compared to traditional transaction sites where there are many verification hurdles (providing proof of national identity card number, proof of bank account and income statement, etc) that a potential user needs to clear before being allowed on the platform.

Recent court cases on NFTs

On 12 May 2021, the first ever NFT lawsuit was filed between plaintiff Jeeun Friel and Dapper Labs Inc and the CEO of Dapper Labs in the case of Jeeun Friel vs. Dapper Labs and Roham Gharegozlou. Plaintiff Fiel alleged that Dapper Labs’ platform, NBA Top Shot, sold securities when it sold NFTs on its platform in violation of securities laws. The Plaintiff asseted that the NFTs should have been registered with the Securities and Exchange Commission, given that the NFTs are digital assets that “derive their value from the success or failure of a given project, promoter, or start-up”.

The judgement in the Dapper Labs case has not yet been delivered. This may be a landmark case that would provide guidance for legal professionals in NFT transactions. The judgement will be interesting as it could shed light on whether NFTs should be considered “securities”, including under Hong Kong’s Securities and Futures Ordinance (the “SFO”).

In the highly publicized legal battle between the record label Plaintiff Roc-A-Fella Records (co-founded by celebrity singer Shawn “Jay-Z” Carter, better known as Jay-Z) and former business partner turned defendant Damon Dash, the courts ruled in favour of the plaintiff by halting Dash’s attempt to sell off Jay-Z’s ‘Reasonable Doubt’ as a NFT. The court ruled that Dash’s attempt to sell virtual ownership of the album’s copyright was a breach of fiduciary duty, as well as an act of conversion and unjust enrichment. “Securities” are defined under the SFO to mean “shares; debentures (e.g. bonds and notes); rights and options in shares and debentures; interests in collective investment schemes; interests commonly regarded as securities but does not include a number of things such as deposits or negotiable certificates or documents evidencing a deposit; or a structured product that does not fall under the current definition of securities and for which the offer documents require SFC authorization under the SFO” under Schedule 1. The position in Hong Kong is that some cryptocurrencies are considered securities while others are not, depending on their value.

Conclusion

2021 appears to be a landmark year for the popularity of and trading activity in NFTs. The NFT market is set to expand even greater, with talks of using NFT to preserve delicate art pieces be a trailblazer in combatting luxury good counterfeits.

To gain a slice of the legal marketplace pertaining to NFT, the lowest hanging fruit for law firms and lawyers would be to help protect clients from deceptive NFT activity. For regulators, it would be prudent to work with NFT platforms to increase consumer protection in NFT transactions. While the regulators work on creating a more comprehensive framework to regulate NFTs, law firms are left to apply existing common law and legislation to the constantly innovating world of NFTs with all its technical variations.

If you are an investor, a creator, or an entertainment company, Hauzen LLP can help you in the following areas of NFT:

- NFT sale transactions

- NFT dispute resolution

- NFT issuance

- Cryptocurrency services

Contact us today for a discussion of how we can help you.